The year began with a burst of announcements by the Obama Administration of cases it rushed to resolve before leaving office. In the period between election day and the inauguration, the Justice Department and various agencies announced more than $30 billion in fines and settlements.

The year began with a burst of announcements by the Obama Administration of cases it rushed to resolve before leaving office. In the period between election day and the inauguration, the Justice Department and various agencies announced more than $30 billion in fines and settlements.

That flurry of activity disappeared once Donald Trump took office. Agency enforcement activity soon resumed, thanks to the efforts of career officials, but it appears that the volume of cases has declined compared to previous years. The same goes for the Justice Department, where high-profile prosecutions of large companies have continued but have become less frequent. Here is a rundown of selected major cases resolved during 2017, divided between the two administrations:

Obama Cases

Sale of Toxic Securities: Two of the year’s biggest penalties came in cases stemming back to the period leading up to the financial meltdown in 2008. During its final days the Obama Justice Department got Deutsche Bank to agree to pay $7.2 billion to resolve allegations that it misled investors in the sale of mortgage-backed securities. A day later it announced that Credit Suisse would pay $5.3 billion in a similar case. Moody’s reached an $864 million settlement with the federal government and 21 states for providing flawed credit ratings on what turned out to be toxic securities.

Money Laundering. In January Western Union agreed to forfeit $586 million and entered into agreements with the Justice Department and the Federal Trade Commission to resolve criminal allegations that it failed to maintain an effective anti-money-laundering system and that it abetted wire fraud.

Environmental Fraud: In January the Justice Department announced that Volkswagen would plead guilty to three felony counts and pay a $2.8 billion penalty to resolve the criminal charges brought against the automaker in connection with its scheme to use a device to cheat on emissions tests.

Auto Safety Fraud: In January Takata Corporation agreed to pay a $1 billion criminal penalty in the case brought against the Japanese company for fraudulent conduct in the sale of defective airbag inflators.

Trump Cases

Sale of Toxic Securities: In July the Federal Housing Finance Agency announced that Royal Bank of Scotland would pay $5.5 billion to settle allegations relating to the sale of mortgage-backed securities to Fannie Mae and Freddie Mac.

Export Control Violations: In March the Commerce Department’s Bureau of Industry and Security announced that the Chinese company ZTE would pay $661 million to resolve allegations that it shipped telecommunications equipment to Iran and North Korea in violation of U.S. export restrictions.

Bribery: In September the Swedish telecommunications company Telia was fined $457 million by the Securities and Exchange Commission for violating the Foreign Corrupt Practices Act through illicit payments to government officials in Uzbekistan.

False Claims Act: In August the pharmaceutical company Mylan agreed to pay $465 million to settle allegations that it misclassified its EpiPen devices as generic drugs to avoid paying rebates to Medicaid.

Illegal Drug Promotion/Distribution: In July the U.S. Attorney’s Office in Los Angeles announced that Celgene would pay $280 million to settle allegations that it illegally promoted two cancer medications for uses not approved by the Food and Drug Administration. In September AmeriSourceBergen pled guilty and agreed to pay a total of $260 million to resolve criminal liability for its distribution of oncology supportive-care drugs from a facility that was not registered with the FDA.

Foreign Exchange Violations: In July the Federal Reserve Board fined the French bank BNP Paribas $246 million for failing to prevent its foreign exchange traders from engaging in market manipulation. In September the Fed fined HSBC $175 million for the firm’s unsafe and unsound practices in its foreign exchange trading business.

Consumer Protection: In August the Consumer Financial Protection Bureau fined American Express $96 million for discriminating against consumers in Puerto Rico, the U.S. Virgin Islands, and other U.S. territories by providing them with credit and charge card terms that were inferior to those available in the 50 states.

Price-Fixing: In May the Justice Department’s Antitrust Division announced that Bumble Bee Foods would pay a criminal fine of $25 million in connection with price-fixing of shelf-stable tuna.

Workplace Harassment: In August the Equal Employment Opportunity Commission announced that Ford Motor would pay up to $10.125 million to workers affected by sexual and racial harassment at two company facilities in the Chicago area.

Fair Labor Standards Act: In March the Labor Department’s Wage and Hour Division announced that the Walt Disney Company would pay $3.8 million in back wages to workers affected by violations of minimum wage and overtime rules.

Environmental Violation: In October Exxon Mobil agreed to pay a penalty of $2.5 million and spend $300 million on air pollution controls to resolve allegations that it violated the Clean Air Act by failing to properly operate and monitor industrial flares at its petrochemical facilities.

Note: Additional details on all these cases can be found in Violation Tracker. During 2017 my colleagues and I expanded the database to 300,000 entries with total penalties of $400 billion. Coverage now includes cases from more than 40 federal regulatory agencies and all divisions of the Justice Department dating back to the beginning of 2000.

The world according to Trump is one of grievances and victimhood. During the presidential campaign he got a lot of mileage by appearing to empathize with the travails of the white working class and promising to be their champion in fighting against the impact of globalization and economic restructuring. At times he even seemed to be adopting traditional left-wing positions by criticizing big banks and big pharma.

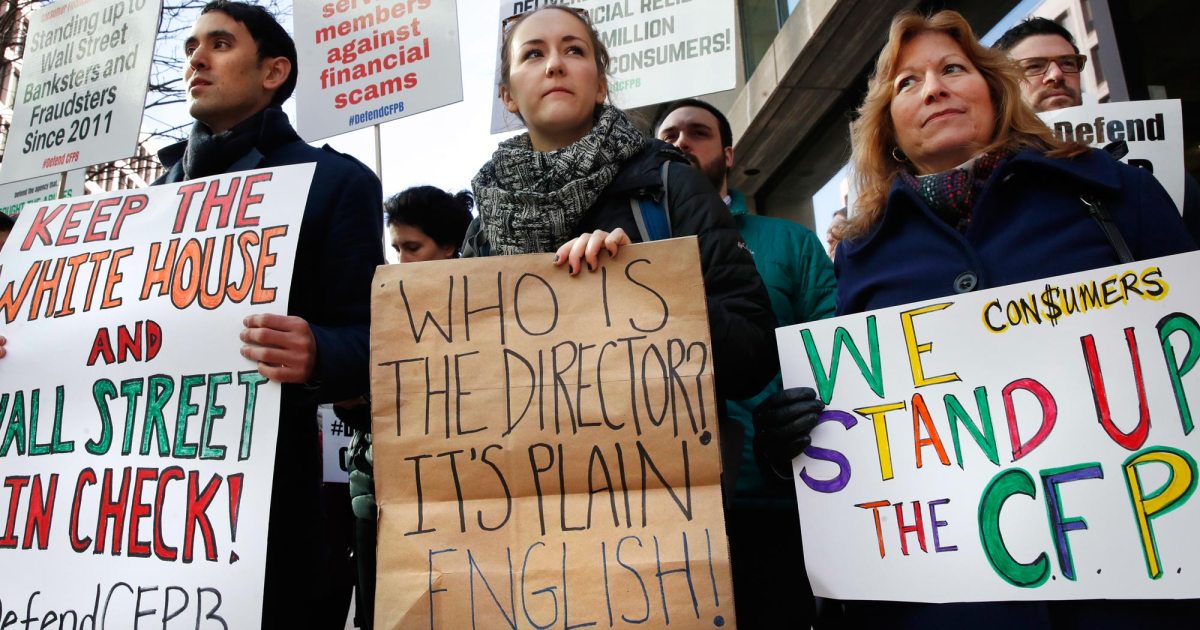

The world according to Trump is one of grievances and victimhood. During the presidential campaign he got a lot of mileage by appearing to empathize with the travails of the white working class and promising to be their champion in fighting against the impact of globalization and economic restructuring. At times he even seemed to be adopting traditional left-wing positions by criticizing big banks and big pharma. It appears that the Trump Administration will not rest until every last federal regulatory agency is under the control of a corporate surrogate. The reverse revolving door is swinging wildly as business foxes swarm into the rulemaking henhouses.

It appears that the Trump Administration will not rest until every last federal regulatory agency is under the control of a corporate surrogate. The reverse revolving door is swinging wildly as business foxes swarm into the rulemaking henhouses. Large corporations in the United States like to portray themselves as victims of a supposedly onerous tax system and a supposedly oppressive regulatory system. Those depictions are a far cry from reality, but that does not stop business interests from seeking to weaken government power in both areas.

Large corporations in the United States like to portray themselves as victims of a supposedly onerous tax system and a supposedly oppressive regulatory system. Those depictions are a far cry from reality, but that does not stop business interests from seeking to weaken government power in both areas. The bizarro-world worker populism of Donald Trump strikes again. The White House recently

The bizarro-world worker populism of Donald Trump strikes again. The White House recently  Once upon a time, there was a debate on how best to check the power of giant corporations. Starting in the Progressive Era and resuming in the 1970s with the arrival of agencies such as the EPA and OSHA, some emphasized the role of government through regulation. Others focused on the role of the courts, especially through the kind of class action lawsuits pioneered by lawyers such as

Once upon a time, there was a debate on how best to check the power of giant corporations. Starting in the Progressive Era and resuming in the 1970s with the arrival of agencies such as the EPA and OSHA, some emphasized the role of government through regulation. Others focused on the role of the courts, especially through the kind of class action lawsuits pioneered by lawyers such as  The withdrawal of Tom Marino’s nomination as national drug czar is a reminder of the power of whistle-blowing and aggressive investigative reporting, while the fact that he was named in the first place is a reminder of the hollowness of the Trump’s Administration’s commitments to draining the swamp and to seriously addressing the opioid epidemic.

The withdrawal of Tom Marino’s nomination as national drug czar is a reminder of the power of whistle-blowing and aggressive investigative reporting, while the fact that he was named in the first place is a reminder of the hollowness of the Trump’s Administration’s commitments to draining the swamp and to seriously addressing the opioid epidemic. The Trump Administration would have us believe it is all about helping workers. Yet it has a strange way of showing it. Policies that directly assist workers are under attack, and all the emphasis is on initiatives that purportedly aid workers indirectly by boosting their employers.

The Trump Administration would have us believe it is all about helping workers. Yet it has a strange way of showing it. Policies that directly assist workers are under attack, and all the emphasis is on initiatives that purportedly aid workers indirectly by boosting their employers. When a new corporate scandal arises, there is a tendency on the part of many observers to treat it as a complete surprise — as something that could not have been anticipated.

When a new corporate scandal arises, there is a tendency on the part of many observers to treat it as a complete surprise — as something that could not have been anticipated. Donald Trump likes to give the impression that he has made great strides in dismantling regulation. While there is no doubt that his administration and Republican allies in Congress are targeting many important safeguards for consumers and workers, the good news is that those protections in many respects are still alive and well.

Donald Trump likes to give the impression that he has made great strides in dismantling regulation. While there is no doubt that his administration and Republican allies in Congress are targeting many important safeguards for consumers and workers, the good news is that those protections in many respects are still alive and well.

You must be logged in to post a comment.