Corporate crime has been with us for a long time, but 2012 may be remembered as the year in which billion-dollar fines and settlements related to those offenses started to become commonplace. Over the past 12 months, more than half a dozen companies have had to accede to ten-figure penalties (along with plenty of nine-figure cases) to resolve allegations ranging from money laundering and interest-rate manipulation to environmental crimes and illegal marketing of prescription drugs.

Corporate crime has been with us for a long time, but 2012 may be remembered as the year in which billion-dollar fines and settlements related to those offenses started to become commonplace. Over the past 12 months, more than half a dozen companies have had to accede to ten-figure penalties (along with plenty of nine-figure cases) to resolve allegations ranging from money laundering and interest-rate manipulation to environmental crimes and illegal marketing of prescription drugs.

The still-unresolved question is whether even these heftier penalties are punitive enough, given that corporate misconduct shows no sign of abating. To help in the consideration of that issue, here is an overview of the year’s corporate misconduct.

BRIBERY. The most notorious corporate bribery scandal of the year involves Wal-Mart, which apart from its unabashed union-busting has tried to cultivate a squeaky clean image. A major investigation by the New York Times in April showed that top executives at the giant retailer thwarted and ultimately shelved an internal probe of extensive bribes paid by lower-level company officials as part of an effort to increase Wal-Mart’s market share in Mexico. A recent follow-up report by the Times provides amazing new details.

Wal-Mart is not alone in its behavior. This year, drug giant Pfizer had to pay $60 million to resolve federal charges related to bribing of doctors, hospital administrators and government regulators in Europe and Asia. Tyco International paid $27 million to resolve bribery charges against several of its subsidiaries. Avon Products is reported to be in discussions with the U.S. Justice Department and the Securities and Exchange Commission to resolve a bribery probe.

MONEY LAUNDERING AND ECONOMIC SANCTIONS. In June the U.S. Justice Department announced that Dutch bank ING would pay $619 million to resolve allegations that it had violated U.S. economic sanctions against countries such as Iran and Cuba. The following month, a U.S. Senate report charged that banking giant HSBC had for years looked the other way as its far-flung operations were being used for money laundering by drug traffickers and potential terrorist financiers. In August, the British bank Standard Chartered agreed to pay $340 million to settle New York State charges that it laundered hundreds of billions of dollars in tainted money for Iran and lied to regulators about its actions; this month it agreed to pay another $327 million to settle related federal charges. Recently, HSBC reached a $1.9 billion money-laundering settlement with federal authorities.

INTEREST-RATE MANIPULATION. This was the year in which it became clear that giant banks have routinely manipulated the key LIBOR interest rate index to their advantage. In June, Barclays agreed to pay about $450 million to settle charges brought over this issue by U.S. and UK regulators. UBS just agreed to pay $1.5 billion to U.S., UK and Swiss authorities and have one of its subsidiaries plead guilty to a criminal fraud charge in connection with LIBOR manipulation.

DISCRIMINATORY LENDING. In July, it was announced that Wells Fargo would pay $175 million to settle allegations that the bank discriminated against black and Latino borrowers in making home mortgage loans.

DECEIVING INVESTORS. In August, Citigroup agreed to pay $590 million to settle a class-action lawsuit alleging that it failed to disclose its full exposure to toxic subprime mortgage debt in the run-up to the 2008 financial crisis. The following month, Bank of America said it would pay $2.4 billion to settle an investor class-action suit charging that it made false and misleading statements during its acquisition of Merrill Lynch during the crisis. In November, JPMorgan Chase and Credit Suisse agreed to pay a total of $417 million to settle SEC charges of deception in the sale of mortgage securities to investors.

DEBT-COLLECTION ABUSES. In October, American Express agreed to pay $112 million to settle charges of abusive debt-collection practices, improper late fees and deceptive marketing of its credit cards.

DEFRAUDING GOVERNMENT. In March, the Justice Department announced that Lockheed Martin would pay $15.9 million to settle allegations that it overcharged the federal government for tools used in military aircraft programs. In October, Bank of America was charged by federal prosecutors with defrauding government-backed mortgage agencies by cranking out faulty loans in the period leading to the financial crisis.

PRICE-FIXING. European antitrust regulators recently imposed the equivalent of nearly $2 billion in fines on electronics companies such as Panasonic, LG, Samsung and Philips for conspiring to fix the prices of television and computer displays. Earlier in the year, the Taiwanese company AU Optronics was fined $500 million by a U.S. court for similar behavior.

ENVIRONMENTAL CRIMES. This year saw a legal milestone in the prosecution of BP for its role in the 2010 Deepwater Horizon drilling accident that killed 11 workers and spilled a vast quantity of crude oil into the Gulf of Mexico. The company pleaded guilty to 14 criminal charges and was hit with $4.5 billion in criminal fines and other penalties. BP was also temporarily barred from getting new federal contracts.

ILLEGAL MARKETING. In July the U.S. Justice Department announced that British pharmaceutical giant GlaxoSmithKline would pay a total of $3 billion to settle criminal and civil charges such as the allegation that it illegally marketed its antidepressants Paxil and Wellbutrin for unapproved and possibly unsafe purposes. The marketing included kickbacks to doctors and other health professionals. The settlement also covered charges relating to the failure to report safety data and overcharging federal healthcare programs. In May, Abbott Laboratories agreed to pay $1.6 billion to settle illegal marketing charges.

COVERING UP SAFETY PROBLEMS. In April, Johnson & Johnson was ordered by a federal judge to pay $1.2 billion after a jury found that the company had concealed safety problems associated with its anti-psychotic drug Risperdal. Toyota was recently fined $17 million by the U.S. Transportation Department for failing to notify regulators about a spate of cases in which floor mats in Lexus SUVs were sliding out of position and interfering with gas pedals.

EXAGGERATING FUEL EFFICIENCY. In November, the U.S. Environmental Protection Agency announced that Hyundai and Kia had overstated the fuel economy ratings of many of the vehicles they had sold over the past two years.

UNSANITARY PRODUCTION. An outbreak of meningitis earlier this year was tied to tainted steroid syringes produced by specialty pharmacies New England Compounding Center and Ameridose that had a history of operating in an unsanitary manner.

FATAL WORKFORCE ACCIDENTS. The Bangladeshi garment factory where a November fire killed more than 100 workers (who had been locked in by their bosses) turned out to be a supplier for Western companies such as Wal-Mart, which is notorious for squeezing contractors to such an extent that they have no choice but to make impossible demands on their employees and force them to work under dangerous conditions.

UNFAIR LABOR PRACTICES. Wal-Mart also creates harsh conditions for its domestic workforce. When a new campaign called OUR Walmart announced plans for peaceful job actions on the big shopping day after Thanksgiving, the company ignored the issues they were raising and tried to get the National Labor Relations Board to block the protests. Other companies that employed anti-union tactics such as lockouts and excessive concessionary demands during the year included Lockheed Martin and Caterpillar.

TAX DODGING. While it is often not technically criminal, tax dodging by large companies frequently bends the law almost beyond recognition. For example, in April an exposé in the New York Times showed how Apple avoids billions of dollars in tax liabilities through elaborate accounting gimmicks such as the “Double Irish with a Dutch Sandwich,” which involves artificially routing profits through various tax haven countries.

FORCED LABOR. In November, global retailer IKEA was revealed to have made use of prison labor in East Germany in the 1980s.

Note: For fuller dossiers on a number of the companies listed here, see my Corporate Rap Sheets. The latest additions to the rap sheet inventory are drug giants AstraZeneca and Eli Lilly.

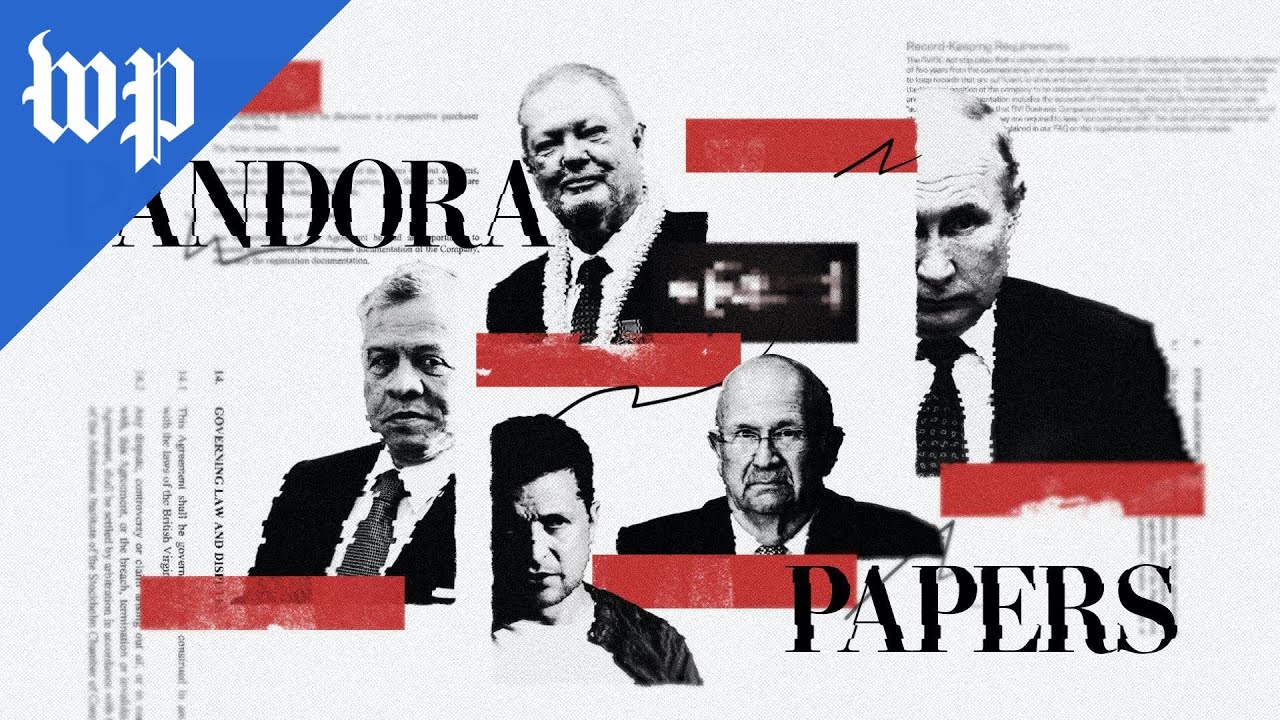

Money laundering has jumped back to the top of the corporate crime charts, thanks to Steve Bannon’s statements about Trump’s associates as well as the

Money laundering has jumped back to the top of the corporate crime charts, thanks to Steve Bannon’s statements about Trump’s associates as well as the  While the spotlight is on Michael Flynn’s discussions with Russia about sanctions, little attention is being paid to the Russian connections of Trump’s Commerce Secretary nominee Wilbur Ross, who if confirmed would oversee an agency involved with enforcing those sanctions.

While the spotlight is on Michael Flynn’s discussions with Russia about sanctions, little attention is being paid to the Russian connections of Trump’s Commerce Secretary nominee Wilbur Ross, who if confirmed would oversee an agency involved with enforcing those sanctions.

You must be logged in to post a comment.