The vast majority of regulatory enforcement cases end with an agreement by the corporation to correct its behavior in the future. Monetary penalties are meant to reinforce the lesson and act as a further deterrent.

The vast majority of regulatory enforcement cases end with an agreement by the corporation to correct its behavior in the future. Monetary penalties are meant to reinforce the lesson and act as a further deterrent.

If only it worked that way. Most large companies are, in fact, repeat offenders. In the recently expanded Violation Tracker database, the 2,000 parent companies account for nearly 30,000 individual cases, an average of 15 each. And that’s only since the beginning of 2010.

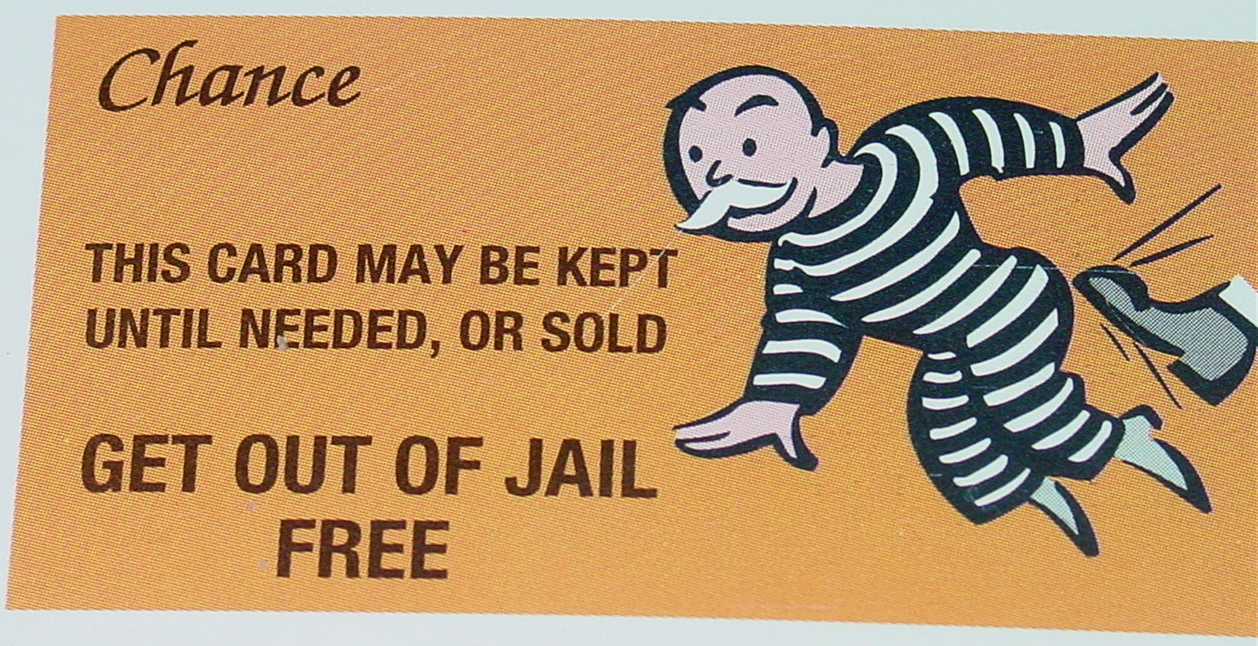

Such recidivism is all the more troubling when a company has faced criminal rather than civil charges and been allowed to evade serious consequences through a deferred prosecution agreement (DPA) or a non-prosecution agreement (NPA). The Justice Department uses these gimmicks to allow corporations to resolve criminal matters by paying a fine while avoiding a guilty plea. The theory is that this brush with the law will prompt the company to come into full compliance. If that does not happen, it faces the threat of a real prosecution.

Of the 80 parent companies in Violation Tracker that have signed a DPA or NPA, about half have subsequently had no other reported offenses. Maybe the Justice Department system does work — in some cases.

Yet the other half includes companies that continued to rack up numerous violations from agencies such as EPA and OSHA with seemingly no concern that this would jeopardize their agreement with DOJ. These serial offenders include some of the world’s largest banks, both those based in the United States and those doing substantial business here.

The track records of nine of these banks contain serious cases that were resolved following a DPA or NPA. In some instances, these subsequent matters involved behavior that completely pre-dated the signing of the agreement with DOJ, but not always.

Take Bank of America, which has the dubious distinction of being the most penalized corporation in Violation Tracker, with a total of $56 billion in fines and settlements. In 2010 it signed an NPA and paid $137 million to resolve civil and criminal charges of conspiring to rig bids in the municipal bond derivatives market. Yet in 2014 the Consumer Financial Protection Bureau announced that BofA would pay a $20 million penalty and some $700 million in consumer relief to resolve allegations that it engage in abusive marketing of credit-card add-on products during a period that continued after 2010. The CFPB did not refer to the earlier bid rigging case and there was no indication that BofA’s NPA was a factor in how the credit-card case was handled.

Several banks have managed to follow one DPA or NPA with another. Deutsche Bank has been allowed to sign three such agreements: one in 2010 relating to fraudulent tax shelters, one in 2015 for manipulation of the LIBOR interest rate benchmark, and another that year by its Swiss subsidiary in a tax case related to undeclared accounts held by U.S. citizens.

In other cases, a DPA or NPA was followed by a guilty plea in another criminal matter. After signing an NPA in 2011 in a municipal bond case and a DPA in 2014 for its relationship to the Madoff Ponzi scheme, JPMorgan Chase went on to plead guilty on a foreign exchange market manipulation charge in 2015.

It seems that previous DPAs or NPAs mean little to subsequent cases unless the offense is exactly the same. In 2015, for instance, Justice rebuked UBS for violating its 2012 NPA relating to LIBOR manipulation and terminated the agreement, forcing the Swiss bank to enter a guilty plea.

These various outcomes seem to make little difference to the banks. They continue to break the law in one way or another while paying affordable penalties and being allowed to go on operating as usual. Life is good for career corporate criminals.

Over the past few years, the Justice Department and state prosecutors have collected tens of billions of dollars in fines and settlements from large banks in a series of cases stemming from fraudulent practices in the period leading up to the financial meltdown of 2008.

Over the past few years, the Justice Department and state prosecutors have collected tens of billions of dollars in fines and settlements from large banks in a series of cases stemming from fraudulent practices in the period leading up to the financial meltdown of 2008. The Big Short movie and the Bernie Sanders presidential campaign are not the only things reminding us about the role of bank misconduct in the financial meltdown. Federal and state prosecutors are continuing to wrap up cases brought against the main culprits.

The Big Short movie and the Bernie Sanders presidential campaign are not the only things reminding us about the role of bank misconduct in the financial meltdown. Federal and state prosecutors are continuing to wrap up cases brought against the main culprits. For a long time the big financial institutions of the United States had an unrelenting urge to grow bigger. Acting on the principle that only the big would survive, banks and related entities spent the 1990s and the early 2000s gobbling up one another at a furious pace. The result was a small group of mega-institutions such as Citigroup and Bank of America that nearly brought down the whole financial system in 2008.

For a long time the big financial institutions of the United States had an unrelenting urge to grow bigger. Acting on the principle that only the big would survive, banks and related entities spent the 1990s and the early 2000s gobbling up one another at a furious pace. The result was a small group of mega-institutions such as Citigroup and Bank of America that nearly brought down the whole financial system in 2008. The ongoing corporate crime wave showed no signs of abating in 2015. BP paid a record $20 billion to

The ongoing corporate crime wave showed no signs of abating in 2015. BP paid a record $20 billion to  We’ve just been treated to the rare sight of a corporate executive pleading guilty to criminal charges stemming from actions that harmed the public. This outcome was particularly satisfying given that the case was one that symbolized much of what is wrong with U.S. business and regulatory practices.

We’ve just been treated to the rare sight of a corporate executive pleading guilty to criminal charges stemming from actions that harmed the public. This outcome was particularly satisfying given that the case was one that symbolized much of what is wrong with U.S. business and regulatory practices. Much of the corporate misconduct of the past decade has involved complicated schemes involving the likes of mortgage-backed securities and credit default swaps. A recent

Much of the corporate misconduct of the past decade has involved complicated schemes involving the likes of mortgage-backed securities and credit default swaps. A recent  In the years following the financial meltdown, corporate critics complained that the big banks were not facing serious legal consequences for their misconduct. They were being allowed to essentially buy their way out of jeopardy through financial settlements under which they admitted no wrongdoing.

In the years following the financial meltdown, corporate critics complained that the big banks were not facing serious legal consequences for their misconduct. They were being allowed to essentially buy their way out of jeopardy through financial settlements under which they admitted no wrongdoing.

You must be logged in to post a comment.