Jack Mitnick may end up denying the presidency to Donald Trump. He also helped deprive me of my inheritance.

As the world now knows, the accountant confirmed to the New York Times the authenticity of leaked Trump tax return documents prepared by him that reported an annual loss of some $916 million in 1995 that may have allowed the mogul to avoid federal taxes for nearly two decades.

Trump was not Mitnick’s only client in the 1990s. He and his firm Spahr Lacher & Sperber also did work for my maternal grandfather Julius Nasso, who owned a concrete construction company in New York City. That firm did quite well for its work on projects such as Madison Square Garden and the Javits Convention Center.

My grandfather, who died in 1999, prospered from the business, but his wealth, I regret to say, was also enhanced through the use of dubious tax shelters involving coal leases. That’s where Mitnick comes in. From what I know, Mitnick’s firm either set up my grandfather in the shelters or at least prepared tax returns in which they were used to greatly reduce his tax liabilities.

The Internal Revenue Service eventually challenged the shelters, but my grandfather, apparently with Mitnick’s help, refused to settle. It was only after his death that the dispute was resolved by my family with a substantial payment to the IRS. One consequence of this was that the bequests in his will to me and the other grandchildren could not be fulfilled.

I long treated this as a private family matter, but after Mitnick’s name appeared in the Times story I did some research on him. I found that in 1981 Mitnick and other parties were sued by William Freschi Jr. in his role as trustee of the estate of his father, who like my grandfather had invested in coal lease tax shelters. The suit accused Mitnick, who was described as the administrator of Grand Coal Venture, and others of defrauding his father.

The case had a long and complicated legal history, including a racketeering charge and an action by the U.S. Supreme Court. In 1985 Mitnick and the other defendants were found guilty of securities fraud and ordered to pay Freschi $266,500 in damages, plus $126,681.75 in pre-judgment interest. The Court of Appeals, however, later overturned the award against Mitnick but did not completely exonerate him.

Given Mitnick’s close working relationship with Trump — the accountant is mentioned in The Art of the Deal — one cannot help wonder whether he also arranged for Trump to participate in the phony coal tax shelters. Given the other tax dodging tricks available in connection with his real estate holdings, Trump may not have needed them, but this is another question that will be answered only when Trump releases his full tax returns.

In the interest of full disclosure, I should mention that my grandfather’s company operated at times in a joint venture with S&A Concrete, a firm with alleged mob connections that separately did substantial business on Trump projects.

The False Claims Act sounds like the name of a Donald Trump comedy routine, but it is actually a 150-year-old law that is widely used to prosecute companies and individuals that seek to defraud the federal government. It is also the focus of the latest expansion of

The False Claims Act sounds like the name of a Donald Trump comedy routine, but it is actually a 150-year-old law that is widely used to prosecute companies and individuals that seek to defraud the federal government. It is also the focus of the latest expansion of

The chief executive of Wells Fargo would have us believe that more than 5,000 of his employees spontaneously became corrupt and decided to create bogus accounts for customers who were then charged fees for services they had not requested.

The chief executive of Wells Fargo would have us believe that more than 5,000 of his employees spontaneously became corrupt and decided to create bogus accounts for customers who were then charged fees for services they had not requested. Apple’s

Apple’s  Price gouging by the producer of EpiPens has been creating a hardship for those suffering from severe allergies, but it is also revealing the truth about the one segment of the drug industry that was thought to have some decency.

Price gouging by the producer of EpiPens has been creating a hardship for those suffering from severe allergies, but it is also revealing the truth about the one segment of the drug industry that was thought to have some decency. The decision by the Justice Department to end its use of privately operated prison facilities is a long overdue reform and one that should also be adopted by the states. Yet the for-profit prison scandals are not limited to those involving companies such as Corrections Corporation of America that are in the business of managing entire correctional facilities.

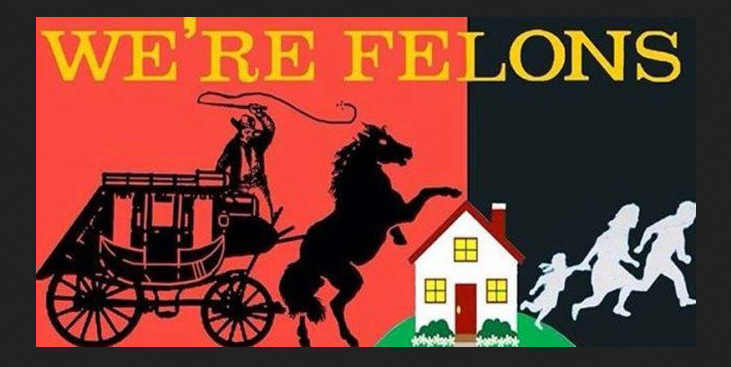

The decision by the Justice Department to end its use of privately operated prison facilities is a long overdue reform and one that should also be adopted by the states. Yet the for-profit prison scandals are not limited to those involving companies such as Corrections Corporation of America that are in the business of managing entire correctional facilities. Donald Trump’s recent economic policy address portrayed an economy crippled by “overregulation.” This came on the heels of his convention acceptance speech depicting a country afflicted by a wave of street crime perpetrated by “illegal immigrants.”

Donald Trump’s recent economic policy address portrayed an economy crippled by “overregulation.” This came on the heels of his convention acceptance speech depicting a country afflicted by a wave of street crime perpetrated by “illegal immigrants.” One of the key building blocks of the Affordable Care Act was the notion that insurance companies would compete with one another to offer good deals to the uninsured once that population was required to purchase coverage. That captive market is not working out as well as hoped.

One of the key building blocks of the Affordable Care Act was the notion that insurance companies would compete with one another to offer good deals to the uninsured once that population was required to purchase coverage. That captive market is not working out as well as hoped.

You must be logged in to post a comment.