Much of the concern about a possible second Trump term has focused on what seem to be his increasingly authoritarian impulses. Yet we should also worry about old-fashioned corruption.

A glaring sign of what may coming has just appeared in the revelation that a businessman with a shady record put up the $175 million bond Trump had to pay while he appeals a civil fraud judgement in New York State. This was after Trump claimed he could not find any company willing to provide the original bond amount of $454 million and successfully begged a state appeals court to reduce the amount.

That businessman is Don Hankey, whose holdings include Knight Specialty Insurance, which provided the bond for what Hankey told the Washington Post was a “modest fee.” He claimed that the bond deal was not meant as a political statement, yet Hankey supported Trump’s claim that the case brought against him by New York Attorney General Letitia James was unwarranted.

Hankey has accumulated most of his fortune, which Forbes estimates at over $7 billion, from making subprime automobile loans via companies such as Westlake Financial, Westlake Services and Wilshire Consumer Credit. These businesses have run afoul of regulators.

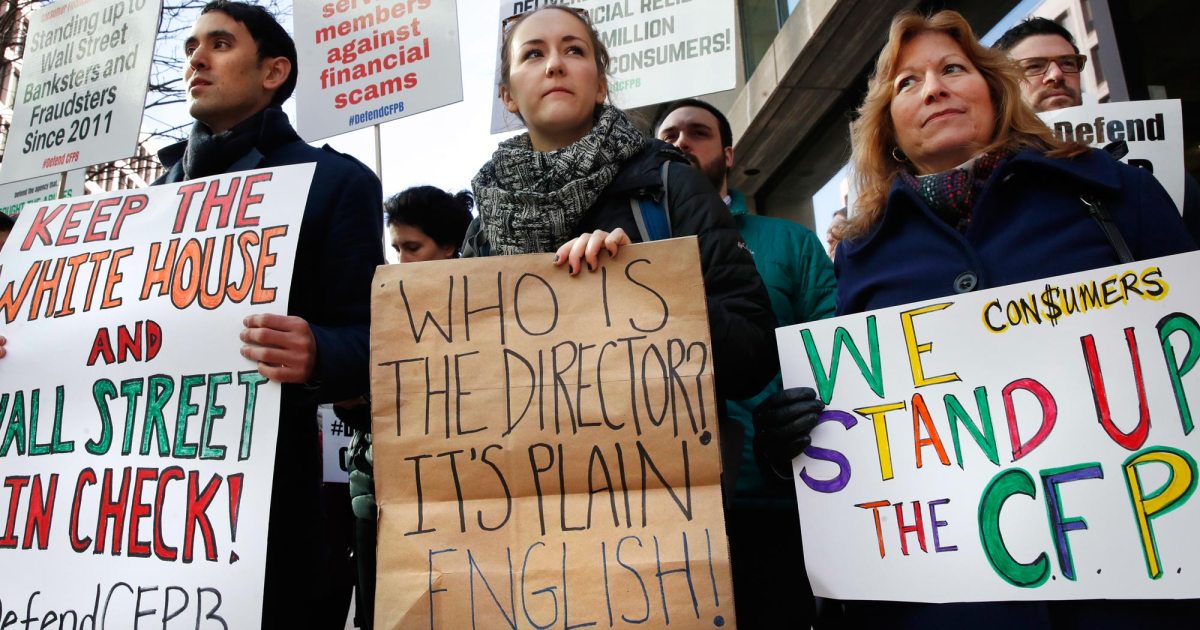

In 2015 the Consumer Financial Protection Bureau hit Westlake Services and Wilshire Consumer Credit with a $48 million penalty, including a fine of $4.25 million and $44.1 million in cash relief and balance reductions for customers the agency said had been subjected to illegal debt collection practices. According to the CFPB, the companies:

- Pretended to call from repo companies by altering caller ID information. The companies’ debt collectors would then make explicit or implicit threats that the borrowers’ vehicles were in imminent danger of being repossessed.

- Altered caller ID information so that it looked like they were calling from unrelated businesses or family members.

- Explicitly and implicitly threatened to file criminal charges against consumers even when they had not decided to refer the borrowers to criminal authorities. These tactics likely misled consumers into believing they needed to make a payment urgently to avoid an investigation.

- Tricked borrowers whose vehicles had been repossessed by making it appear their calls were coming from a party associated with the word Storage. During some of these calls, the companies’ debt collectors implied that the vehicles would be released if the borrowers made a partial payment on the account; however, the companies would actually only release a repossessed vehicle after a borrower paid the full amount due.

- Called consumers’ employers, friends, and family members without permission and told them that consumers were delinquent on loans or facing repossession, investigation, or criminal charges.

- Paid a repo company to make collections calls to consumers, even when the companies had not decided to repossess the consumers’ vehicles or the companies had no reason to believe repossession was imminent. This tactic likely misled consumers into believing that they needed to make a payment urgently to avoid repossession.

The CFPB also accused Westlake and Wilshire of violating federal consumer financial laws in their advertising, customer relations, and account servicing practices. These were said to include changing the due dates on accounts or extended loan terms without consulting consumers and giving consumers incomplete information about the true cost of their loans.

In 2016 the Massachusetts Attorney General’s Office announced that Westlake Services would provide $5.7 million in relief to consumers to resolve allegations that the company charged excessive interest rates on subprime auto loans.

In 2017 Westlake Services and Wilshire Consumer Credit had to pay $760,000 to resolve a case brought by the U.S. Justice Department alleging they violated the Servicemembers Civil Relief Act by repossessing vehicles from members of the military without the required court orders.

Are we expected to believe that the owner of a business such as this is helping Trump solely out of the goodness of his heart? It seems a lot more likely that Hankey is currying favor with Trump in the hope of receiving future assistance from the White House in dealing with pesky regulators.

It is not difficult to imagine that Trump would use a new stint in the Oval Office for such purposes. After all, this kind of corruption was a constant theme during his first term, when special interest groups seeking presidential help could simply book an event or a block of rooms at Trump’s hotel on Pennsylvania Avenue.

What is amazing is that this kind of mischief seems to be happening again even before Trump has won the election or taken office.

The world according to Trump is one of grievances and victimhood. During the presidential campaign he got a lot of mileage by appearing to empathize with the travails of the white working class and promising to be their champion in fighting against the impact of globalization and economic restructuring. At times he even seemed to be adopting traditional left-wing positions by criticizing big banks and big pharma.

The world according to Trump is one of grievances and victimhood. During the presidential campaign he got a lot of mileage by appearing to empathize with the travails of the white working class and promising to be their champion in fighting against the impact of globalization and economic restructuring. At times he even seemed to be adopting traditional left-wing positions by criticizing big banks and big pharma. Trump’s travel ban and his rightwing Supreme Court pick are troubling in themselves, but they are also serving to deflect attention away from the plot by the administration and its Republican allies to undermine the regulation of business.

Trump’s travel ban and his rightwing Supreme Court pick are troubling in themselves, but they are also serving to deflect attention away from the plot by the administration and its Republican allies to undermine the regulation of business. Reincorporating in foreign countries with lower tax rates is not the only way large corporations put profit before patriotism. A

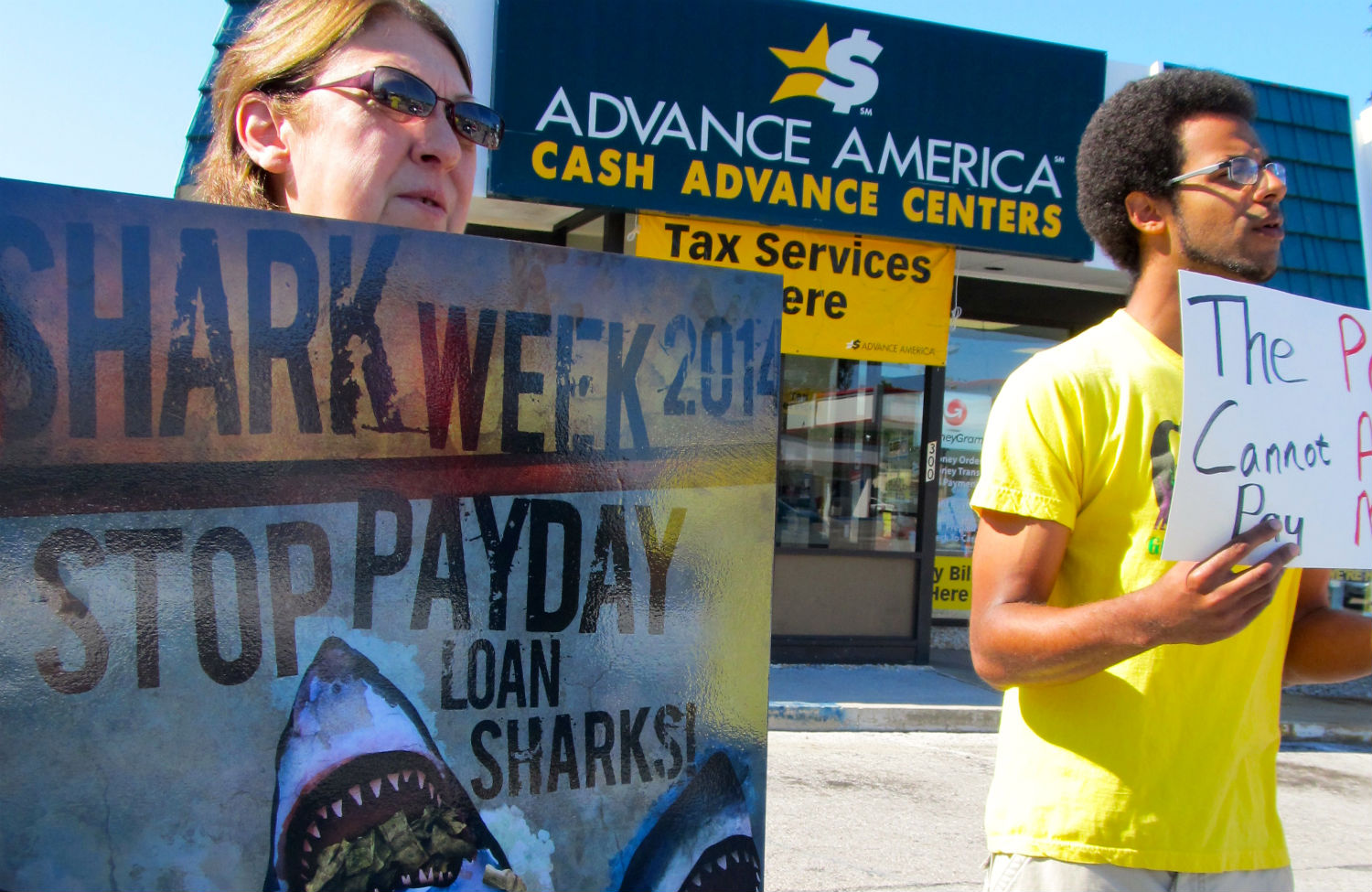

Reincorporating in foreign countries with lower tax rates is not the only way large corporations put profit before patriotism. A  Every industry has its faults, but there are only a few for which it can be said that society would be better off if they did not exist at all. One member of that special group is payday lending, the business of providing short-term cash advances to desperate people at unconscionably high interest rates with the expectation that they will not be able to repay the money and thereby get caught in an ever-worsening debt trap.

Every industry has its faults, but there are only a few for which it can be said that society would be better off if they did not exist at all. One member of that special group is payday lending, the business of providing short-term cash advances to desperate people at unconscionably high interest rates with the expectation that they will not be able to repay the money and thereby get caught in an ever-worsening debt trap. The business news has been full of speculation on whether JPMorgan Chase Jamie Dimon will go on serving as both CEO and chairman of the big bank, in light of a shareholder campaign to strip him of the latter post. The effort to bring Dimon down a notch—and to oust three members of the board—is hardly the work of a “lynch mob,” as Jeffrey Sonnenfeld of Yale

The business news has been full of speculation on whether JPMorgan Chase Jamie Dimon will go on serving as both CEO and chairman of the big bank, in light of a shareholder campaign to strip him of the latter post. The effort to bring Dimon down a notch—and to oust three members of the board—is hardly the work of a “lynch mob,” as Jeffrey Sonnenfeld of Yale  Undeterred by its eviction from public parks in numerous cities, the Occupy movement is looking to other venues, among them college campuses.

Undeterred by its eviction from public parks in numerous cities, the Occupy movement is looking to other venues, among them college campuses.